It’s not hard to hear people throughout our country talking about how expensive everything is getting. They say inflation is through the roof, gas prices are up, or we are facing an impending recession. In today’s media, there seems to be a certain stigma around the word “recession” that has led to the spread of misinformation. A recession is generally defined as a consistent fall in GDP over two or more consecutive quarters, and usually corrects itself. Based on an expert review by J.P. Morgan, we aren’t in a recession, but there is a rising chance that we will be facing a global recession in the near future. General panic about the economy usually begins once experts start saying that we are in a recession and the media catches wind of it. Regardless of whether we’re in a recession or not, the economy is making ordinary life harder with each passing day.

The most prominent recession that we can refer back to is the Great Recession of 2007 which lasted up until 2009. A slew of complex economic activities led to millions of Americans being unable to pay their mortgage with quickly rising rates. Some of the same circumstances have led to a frighteningly reminiscent economic situation today. COVID-19 led millions of people across the world to prepare for the worst by stocking up on necessities like canned goods, hand sanitizer, and most famously toilet paper. This hoarding meant that shelves of stores were left empty and created an absurdly high demand for goods that no longer were available. Some experts have suggested this led to the unrelenting inflation we see today.

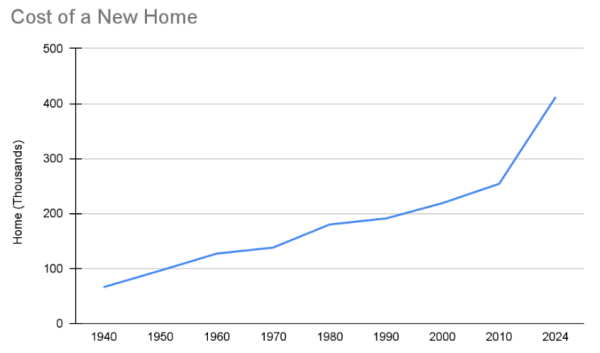

The American economy of today causes difficulty in the lives of millions, but is it harder today than it was in the past, or is that just life? To get some answers, we can look back a few decades and run the numbers. Based on the inflation of the American dollar since 1970, a single dollar would be worth about eight dollars today, so the following statistics will be scaled up roughly by a factor of eight to compensate for inflation.

In 1970, the average price of a home was $27,000 ($218,970 in 2024). Today in 2024, the average price of a home is up to $412,300.

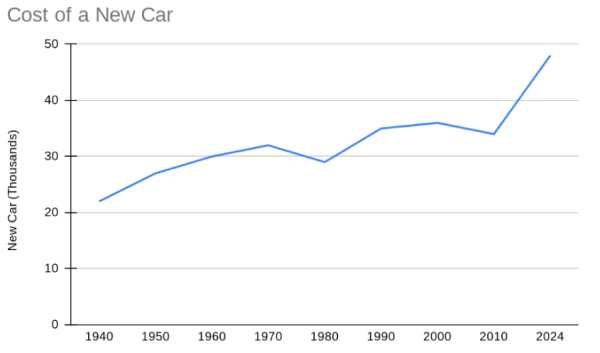

In 1970, the average price of a new car was $3,543 ($28,733 in 2024). Now, new cars average at $47,870.

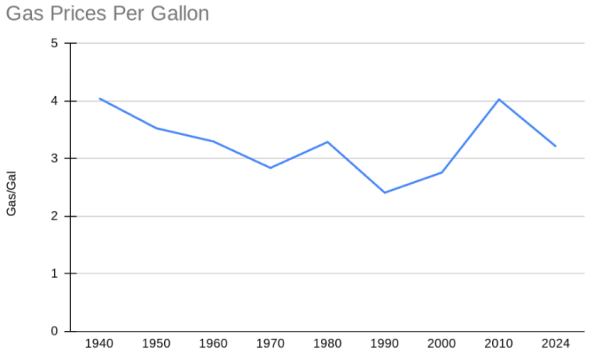

Gas prices in 1970 were $0.36/gallon ($2.86 in 2024), and now they’re $3.18/gallon.

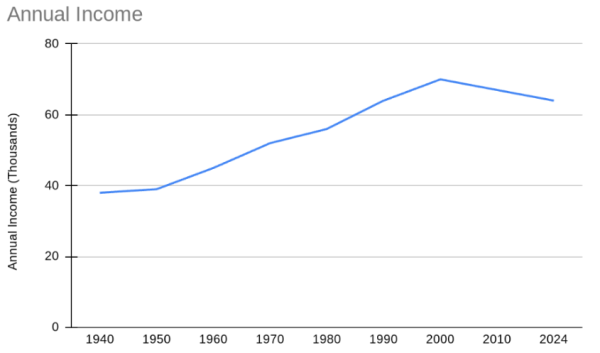

The average annual income in 1970 was about $4700 ($38,000 in 2024). The average annual income is now $64,000.

All of these common products impact the daily lives of everyone regardless of how old they are, no matter what state they live in. This overall rise in prices wouldn’t be so impactful if the average annual income was rising with it, but it isn’t. The average annual income of someone in 1970 was $7,596. This would be $61,628 today, but the average annual income has not only not gone up, but has gone down to $59,384. All of this information together means that the current American economy is most definitely making daily life more difficult.

The generations today that are transitioning into adulthood have begun to worry about what life is going to look like if they continue to watch prices across the board tick up while wages go down. Many individuals in this generation are desperately trying to find a way to keep up with this quickly changing economic climate. The best way that they have seen to do this is by going to college to help their chances at starting a professional career that will allow them to stay afloat. This is just as big of an issue because tuition and housing fees are going up as well.

While we may not currently be in a recession, the rise in the price of everyday goods, housing, and education is creating financial pressure for millions of Americans. The comparison of the economy of the past against today provides undoubted evidence that the financial challenges of today are substantial. However, because of how hard it is to keep up in our current economy, it’s just as hard to get into it as younger generations begin to enter adulthood. This is only made worse by the pressure of rising tuition fees for college students, forcing many of them to apply for student loans. Whether we officially enter a recession or not, economic pressure is reshaping the way people live, work, and plan for the future.